Are you considering bidding farewell to your PNC checking account? Whether you’re switching banks, consolidating your accounts, or just ready to move on, closing your account properly is key. But fret not! We’ve got you covered with a step-by-step guide to make the process as smooth as butter.

Introduction

Closing a bank account might sound like a headache, but armed with the right info, it’s a breeze. In this guide, we’ll walk you through the nitty-gritty of closing your PNC checking account. From gathering required info to confirming closure, we’ve got every base covered.

Why Close Your PNC Bank Account?

Before we delve into the specifics of closing your account, let’s briefly touch on why you might be considering this option. There could be various reasons for wanting to close your PNC Bank account, such as:

- Switching Banks: You may have found a better banking option elsewhere.

- Fee Concerns: If you’re unhappy with the fees or service charges associated with your PNC account.

- Change in Financial Needs: Your financial circumstances or needs may have evolved, necessitating a different type of account.

- Customer Service: Dissatisfaction with the level of customer service provided by PNC Bank.

Whatever your reason, rest assured that closing your PNC Bank account is a straightforward process that we’ll guide you through step by step.

Also read: How to Activate Way2Go Card

Step 1: Gather Required Information

Let’s kick things off by gathering all the essentials. Before you bid adieu to your PNC account, make sure you have:

| Information | Details |

|---|---|

| Account Info | PNC checking account number and routing number |

| Identification | Valid government-issued ID (e.g., driver’s license, passport) |

| Transactions | Note any pending transactions or outstanding checks |

| Alternatives | Research and choose your new bank |

Step 2: Stop Incoming Transactions

Before you say goodbye to PNC, halt all incoming transactions to avoid any hiccups. Here’s how:

- Update Direct Deposit: Inform your employer or benefits provider about the account closure and provide new account details.

- Cancel Recurring Payments: Bid farewell to recurring payments or automatic withdrawals.

- Notify Incoming Payers: Let individuals or organizations paying you know about the change.

Step 3: Transfer Funds

Now, let’s ensure your funds find their way to their new home sweet home:

- Transfer to a New Account: Move your money to your new bank through electronic transfer or old-school check deposit.

- Withdraw in Person: If you prefer cash, swing by a PNC branch with proper identification.

- Write Checks: Clear any outstanding checks from your PNC account.

Step 4: Cancel Automatic Payments and Direct Deposits

Time to cut the cord with automatic payments and direct deposits:

- Review Your Accounts: Take stock of all automatic payments and direct deposits.

- Contact the Payees: Let them know about the change and provide new account details.

- Notify Direct Deposit Providers: Ensure a smooth transition of direct deposits to your new account.

Step 5: Contact Customer Service

Before sealing the deal, touch base with PNC’s customer service for any final clarifications:

- Call or Visit a Branch: Reach out to PNC’s customer service for personalized assistance.

- Clarify Any Doubts: Ask away! Get all your closure-related queries resolved.

- Follow Their Guidance: PNC’s reps will guide you through any remaining steps.

Also read: Guide to Cashing Checks at PLS

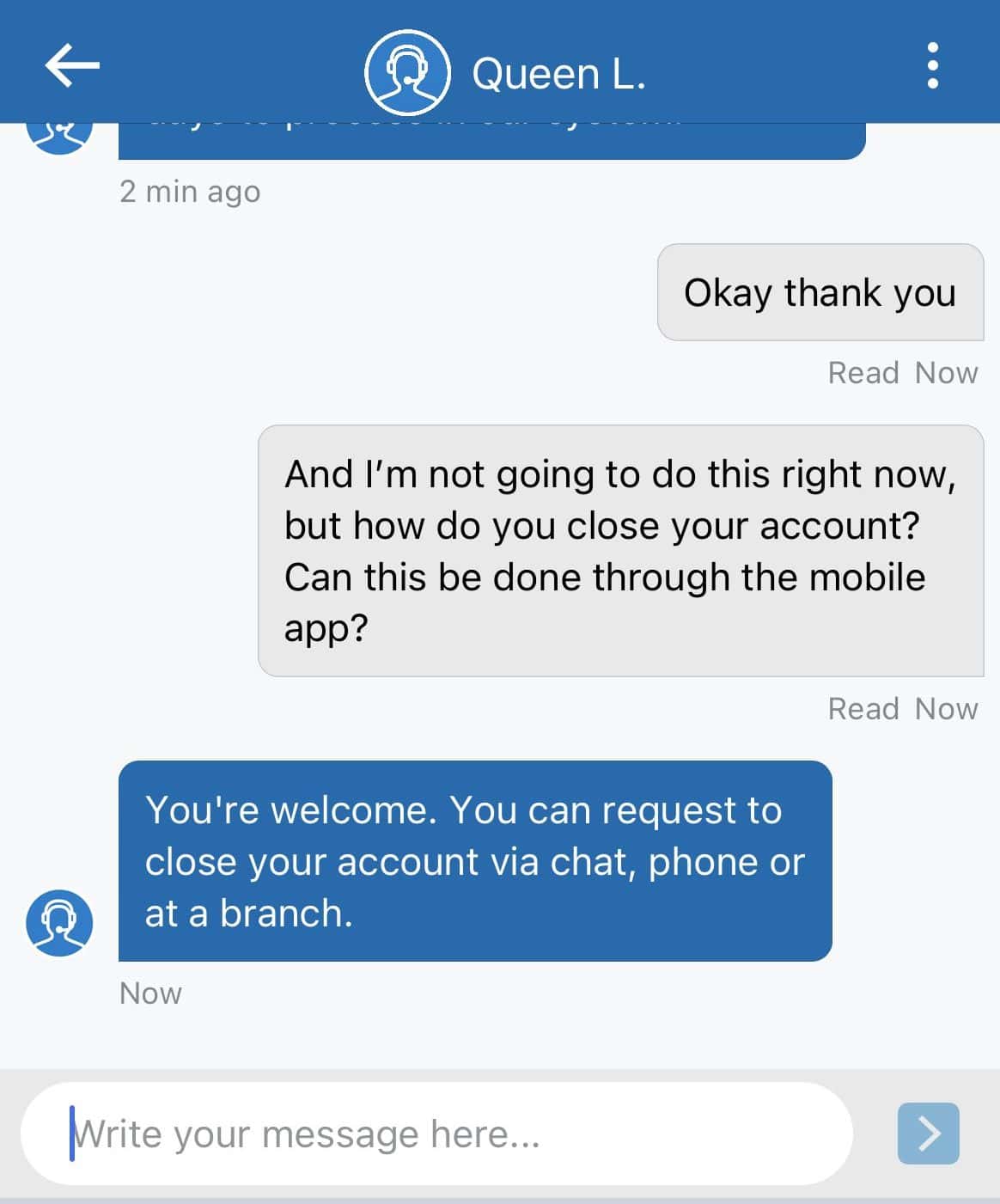

Step 6: Submit Closure Request

It’s official! Time to submit that closure request:

- Choose Your Method: Pick your preferred way to initiate the closure process.

- Complete the Form: Fill out all required details accurately.

- Submit Away: Send off your closure request and keep a copy for your records.

Step 7: Confirm Account Closure

Last but not least, ensure the deed is done:

- Monitor Your Account: Keep tabs on your PNC account during the closure process.

- Receive Confirmation: Once closed, expect confirmation from PNC.

- Verify Zero Balance: Ensure your account shows a clean slate.

Conclusion

And there you have it, folks! With these steps, bidding farewell to your PNC checking account is a walk in the park. Remember, keep communication lines open, stay vigilant, and before you know it, you’ll be onto greener banking pastures.

Also read: Burlington Credit Card

Questions and Answers

- Q: Can I close my PNC checking account online? A: Yes, you can initiate the closure process online through your PNC online banking portal.

- Q: How long does it take to close a PNC checking account? A: The closure process typically takes a few business days to complete.

- Q: Are there any fees for closing my PNC checking account? A: PNC may charge fees for closing your account, depending on your account type and circumstances.

- Q: Can I reopen a closed PNC checking account? A: Yes, you may be able to reopen a closed account by contacting PNC’s customer service.

- Q: What happens if I still have funds in my PNC checking account after closure? A: Any remaining funds will be disbursed to you according to PNC’s policies, typically via check or electronic transfer.

- Q: Will closing my PNC checking account affect my credit score? A: Closing a checking account typically doesn’t directly impact your credit score.

- Q: Can I close my PNC checking account if it’s overdrawn? A: Yes, you can still close an overdrawn account, but you may need to settle any negative balances first.

- Q: Can I close my PNC checking account over the phone? A: Yes, you can contact PNC’s customer service to initiate the closure process over the phone.

- Q: Will I receive a confirmation when my PNC checking account is closed? A: Yes, PNC will provide confirmation once your account closure is processed.

- Q: Can I close my PNC checking account if I have pending transactions? A: It’s recommended to resolve any pending transactions before closing your account to avoid complications.

Comments 1