Welcome to the realm of dividend reinvestment with Fidelity! Whether you’re a seasoned investor or just dipping your toes into the world of stocks, understanding how to reinvest dividends can be a game-changer for your financial journey. In this comprehensive guide, we’ll walk you through the ins and outs of dividend reinvestment with Fidelity, exploring its benefits, setting it up step-by-step, and providing tips to maximize your returns.

Understanding Dividend Reinvestment

Dividend reinvestment is more than just a fancy term – it’s a powerful wealth-building strategy. Instead of cashing out your dividend payments, reinvesting dividends allows you to purchase additional shares of the same stock or mutual fund automatically. This simple action sets in motion a process known as compounding, where your reinvested dividends can generate even more dividends over time.

Benefits of Dividend Reinvestment:

| Benefits | Description |

|---|---|

| Maximizes Total Return | Reinvested dividends can lead to exponential growth, maximizing the total return on your investments. |

| Enhances Compounding Effect | By increasing the number of shares you hold, dividend reinvestment fuels the compounding effect, amplifying your overall returns. |

| Smoothes Market Volatility | Continuously reinvesting dividends, regardless of market conditions, helps to mitigate volatility and potentially enhance long-term gains. |

Benefits of Reinvesting Dividends with Fidelity

Reinvesting dividends with Fidelity offers a plethora of advantages for investors aiming to grow their wealth steadily. Let’s delve into the key benefits that make Fidelity a top choice for dividend reinvestment:

- Compounding Returns: With Fidelity, your reinvested dividends can generate their own dividends, accelerating your overall returns over time.

- Convenience and Automation: Fidelity’s automated reinvestment program saves you time and effort by handling the reinvestment process seamlessly.

- Cost-Efficient: Enjoy commission-free reinvestment of dividends with Fidelity, maximizing the value of your returns.

- Diversification: Access a diverse range of dividend-paying stocks and mutual funds, allowing you to build a well-balanced portfolio.

- Access to Research and Tools: Benefit from Fidelity’s comprehensive research tools and educational resources to make informed investment decisions.

- Flexibility: Customize your reinvestment strategy according to your investment goals and risk tolerance.

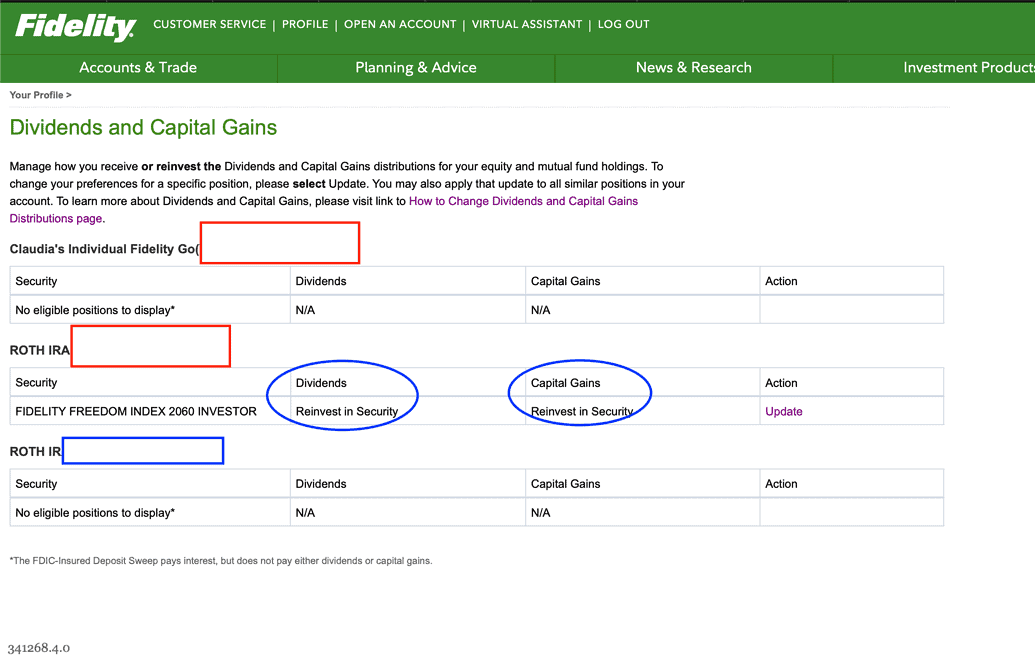

Setting Up Dividend Reinvestment with Fidelity

Setting up dividend reinvestment with Fidelity is a breeze. Follow these straightforward steps to get started:

- Open an Account: If you’re new to Fidelity, open an account that suits your investment needs.

- Choose Investments: Select dividend-paying stocks or funds that align with your investment strategy.

- Verify Eligibility: Confirm that your chosen securities are eligible for reinvestment.

- Set Up Reinvestment: Enroll in Fidelity’s dividend reinvestment program through your account settings.

- Review and Confirm: Double-check your enrollment details and confirm your preferences.

- Monitor and Manage: Keep track of your reinvestment progress and adjust your strategy as needed.

Setting Up Fidelity for Dividend Reinvestment: A Step-by-Step Guide

Step 1: Open a Fidelity Account

Embark on your journey to financial prosperity by opening a Fidelity brokerage account. With a few simple steps, you can gain access to a world of investment opportunities and set the stage for long-term wealth accumulation. Remember, the first step towards financial success begins with a single account.

Step 2: Select the Investments You Want to Reinvest Dividends

With your Fidelity account up and running, it’s time to handpick the investments that align with your investment objectives. Whether you’re drawn to individual stocks or diversified mutual funds, Fidelity offers a wealth of options to suit every investor’s needs. Take your time to research and choose wisely; your financial future depends on it.

Step 3: Set Up Your Dividend Reinvestment Plan

Once you’ve selected your investments, it’s time to establish your dividend reinvestment plan. By automating the process, you can ensure a seamless reinvestment experience while staying focused on your long-term goals. Whether you prefer a hands-on approach or a set-it-and-forget-it strategy, Fidelity has you covered every step of the way.

Step 4: Choose the Frequency of Reinvestment

Tailor your reinvestment strategy to match your investment timeline and objectives. Whether you opt for quarterly, semi-annual, or annual reinvestment, Fidelity offers flexible options to suit your needs. By reinvesting dividends at strategic intervals, you can maximize growth potential and accelerate your journey towards financial independence.

Step 5: Review and Confirm Your Plan

Before finalizing your dividend reinvestment plan, take a moment to review and confirm your selections. Ensure alignment with your investment goals, risk tolerance, and overall financial strategy. With a clear plan in place, you can navigate the complexities of the market with confidence and clarity.

Tools and Resources for Dividend Reinvestment

Fidelity provides a suite of tools and resources to support your dividend reinvestment journey:

- Dividend Reinvestment Calculator: Estimate the growth of your reinvested dividends over time.

- Research and Insights: Access market research reports and analyst recommendations to inform your investment decisions.

- Education Center: Explore a wealth of educational materials to deepen your understanding of dividend investing.

- Portfolio Analysis Tools: Track your portfolio performance and evaluate your dividend reinvestments.

- Mobile Apps: Manage your investments on the go with Fidelity’s mobile apps.

- Customer Support: Reach out to Fidelity’s customer support team for assistance and guidance.

Tips for Maximizing Dividend Reinvestment

To make the most out of your dividend reinvestment strategy with Fidelity, consider these tips:

- Invest in Dividend Aristocrats: Allocate a portion of your reinvestment to companies with a strong history of increasing dividends.

- Diversify Your Holdings: Spread your investments across different sectors to minimize risk.

- Regularly Review Your Strategy: Monitor your reinvestment progress and make adjustments as needed.

- Stay Informed: Take advantage of Fidelity’s research tools and educational resources to make informed decisions.

- Reinvest Regularly: Consistently reinvest your dividends to benefit from the power of compounding.

Monitoring Your Dividend Reinvestment Plan

Stay Informed

- Track Performance: Monitor total return, dividend yield, and portfolio growth to gauge the effectiveness of your investment strategy.

- Assess Benefits: Take advantage of shareholder perks and discounts to optimize your dividend reinvestment plan.

- Regular Analysis: Conduct thorough investment analysis to identify areas for improvement and fine-tune your portfolio for maximum returns.

Investing in your financial future starts with a single step. By reinvesting dividends with Fidelity, you’re not just investing in stocks; you’re investing in your dreams, your goals, and your future. So why wait? Take the plunge today and unlock the power of dividend reinvestment with Fidelity.

Conclusion

Congratulations! You’re now equipped with the knowledge and tools to embark on your dividend reinvestment journey with Fidelity. By harnessing the power of compounding and leveraging Fidelity’s resources, you can pave the way for long-term financial success. Start reinvesting today and watch your investments grow steadily over time.

Frequently Asked Questions (FAQs)

- What is dividend reinvestment?

- Dividend reinvestment is a strategy where investors use their dividend payments to purchase additional shares of the same stock or fund automatically.

- Why reinvest dividends with Fidelity?

- Reinvesting dividends with Fidelity offers convenience, automation, cost-efficiency, diversification, and access to research and tools.

- How do I set up dividend reinvestment with Fidelity?

- Follow our step-by-step guide to enroll in Fidelity’s dividend reinvestment program and start reinvesting your dividends effortlessly.

- Can I choose which investments to reinvest dividends into?

- Yes, Fidelity offers flexibility, allowing you to select the securities you wish to reinvest dividends into based on your investment goals.

- How often should I review my dividend reinvestment strategy?

- It’s recommended to regularly review your strategy and make adjustments as needed to ensure it aligns with your financial goals.

- Are there any fees associated with dividend reinvestment with Fidelity?

- Fidelity often allows for commission-free reinvestment of dividends, making it a cost-efficient option for investors.

- Can I reinvest dividends through Fidelity’s mobile app?

- Yes, Fidelity’s mobile apps provide convenient features for managing your dividend reinvestment on the go.

- What are the benefits of reinvesting dividends?

- Reinvesting dividends maximizes total returns, enhances the compounding effect, and helps to smooth out market volatility.

- How can I diversify my dividend reinvestment portfolio?

- Diversify your holdings across different sectors and industries to spread risk and enhance long-term stability.

- Is dividend reinvestment suitable for all investors?

- Dividend reinvestment is particularly beneficial for long-term investors looking to grow their wealth steadily over time.