Welcome to our detailed guide on managing your Burlington Credit Card payments! Being a responsible credit card holder involves making timely payments to maintain a healthy credit score and avoid unnecessary fees. The Burlington Credit Card offers convenience and rewards, but understanding the payment process is essential. In this guide, we’ll walk you through every step, from account creation to troubleshooting tips.

Burlington Credit Card Benefits and Drawbacks

1. Benefits Unveiled

Let’s start with the perks that make the Burlington credit card shine:

| Benefits | Description |

|---|---|

| Earn 1 point for every $1 spent | Accumulate points effortlessly while indulging in your favorite Burlington shopping spree. |

| Enjoy a 10% discount on your first purchase | Dive into savings right from the get-go with an exclusive discount when you open and use your Burlington credit card. |

2. Drawbacks Exposed

But wait, before you swipe, consider these potential downsides:

- Limited Usage: The Burlington credit card is confined to purchases at Burlington Coat Factory, Cohoes Fashions, and MJM Designer Shoes. If versatility is your game, this card might not make the cut.

- Underwhelming Rewards Rate: While the point value is high at 5 cents each, the earning rate of 1 point per $1 spent might leave you wanting more.

- Expiration Headache: Points and reward certificates come with an expiry date. Keep a close eye on those dates to avoid missing out on your well-deserved rewards.

- High-Interest Rates: With a purchase APR soaring above 33%, carrying a balance on your Burlington credit card can quickly become a costly affair. Play it safe and aim to clear your balance in full each month.

Also read: Code 571

Is it a Good Fit for You?

1. Shopaholics Beware

If you’re a frequent visitor to Burlington Coat Factory and its sister stores, the Burlington credit card could be a match made in shopping heaven. With its high point value, you can rack up rewards faster than you can say “retail therapy.”

2. The Budget-Conscious Shopper

For those mindful of their spending, the allure of a 10% discount on the first purchase might not be enough to outweigh the potential drawbacks. Consider weighing your options carefully before committing to the Burlington credit card.

Step 1: Create an Account with Burlington Credit Card

Creating an online account with Burlington Credit Card is the first step towards managing your payments efficiently. Here’s how:

| Steps | Description |

|---|---|

| Visit the website | Navigate to the official Burlington Credit Card website. |

| Click “Sign Up” | Look for the “Sign Up” or “Register” button on the homepage. |

| Provide necessary information | Fill out the registration form with your details. |

| Verify your email | Click on the verification link sent to your email. |

| Set up security measures | Follow prompts to set up additional security measures. |

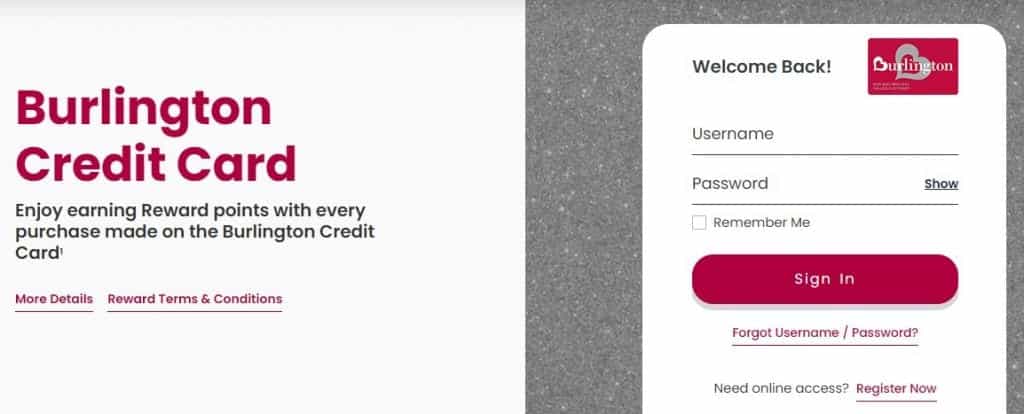

Step 2: Login to Your Burlington Credit Card Account

Logging in to your account is straightforward:

| Steps | Description |

|---|---|

| Visit the website | Go to the Burlington Credit Card website. |

| Click “Login” | Find the “Login” or “Sign In” button and click on it. |

| Enter login details | Input your username and password. |

| Click “Login” | Once details are entered, click on the “Login” button to access your account. |

Step 3: Add Your Payment Method

Adding a payment method enables you to make payments conveniently:

| Steps | Description |

|---|---|

| Access payment settings | Navigate to the payment or payment settings section. |

| Choose payment method | Select from options like credit/debit cards or bank transfers. |

| Enter payment details | Provide required information such as card number, expiry date, and billing address. |

| Save payment method | After entering details, save or add the payment method to your Burlington Credit Card account. |

Step 4: Set up Automatic Payments

Automating payments ensures timely transactions without manual intervention:

| Steps | Description |

|---|---|

| Access payment settings | Go to the payment settings or options section. |

| Choose automatic payments | Opt for automatic payments and select your preferred payment method. |

| Specify payment amount | Determine the amount to be paid automatically each month. |

| Select payment date | Choose a suitable date for the automatic payment to be processed monthly. |

| Save or confirm settings | Save or confirm your preferences to set up automatic payments successfully. |

Step 5: Make a Manual Payment

For those who prefer manual control or need to make a one-time payment:

| Steps | Description |

|---|---|

| Access payment section | Log in to your Burlington Credit Card account and locate the payment section. |

| Choose payment method | Select the desired payment method for this manual transaction. |

| Enter payment details | Input payment information including amount and any additional instructions. |

| Review and confirm | Double-check payment details and confirm the transaction. |

| Receive confirmation | After submission, expect confirmation of the successful payment. |

Step 6: Check Your Payment History

Monitoring payment history ensures accuracy and helps identify discrepancies:

| Steps | Description |

|---|---|

| Login to your account | Access your Burlington Credit Card account using your credentials. |

| Navigate to payment history | Find the section dedicated to viewing payment history within your account. |

| Review payment history | Check for past payments, ensuring all transactions are accurately recorded. |

| Check for pending payments | Monitor any pending transactions until they are cleared. |

| Save or print history | Optionally, save or print your payment history for reference or documentation. |

Step 7: Troubleshooting Tips

Addressing common payment-related issues:

| Steps | Description |

|---|---|

| Verify payment details | Double-check entered information for accuracy. |

| Ensure sufficient funds | Make sure you have enough funds available for the transaction. |

| Update payment method | Keep payment information up to date, especially if cards expire or accounts change. |

| Contact customer support | Reach out to Burlington Credit Card support for assistance with technical issues or queries. |

| Check for system updates | Stay informed about any updates or maintenance affecting the payment system. |

| Clear browser cache | Resolve website-related issues by clearing cache and cookies in your browser. |

| Try different browser or device | Switch to an alternate browser or device to troubleshoot platform-specific issues.

|

Frequently Asked Questions

- Can I use my Burlington credit card anywhere else?

- Unfortunately, no. The card is limited to purchases at Burlington Coat Factory, Cohoes Fashions, and MJM Designer Shoes. Also read: American Express Credit Limit Increase

- What happens if my reward certificates expire?

- Once expired, reward certificates lose their value. Be sure to utilize them within the 60-day window to avoid disappointment.

- How often do points expire?

- Points expire 12 months after they’re posted to your account. Keep track of your points and convert them to certificates regularly to maximize their value.

- Is there a way to avoid paying high-interest rates?

- Absolutely! Clear your credit card balance in full and on time each month to steer clear of hefty interest charges.

- Can I earn points on non-Burlington purchases?

- Unfortunately, no. The Burlington credit card is exclusively for purchases within the Burlington brand family.

- What are the alternatives to the Burlington credit card?

- Consider exploring general cash-back credit cards or secured cards with higher rewards rates for a more versatile spending experience.

- How long does it take to receive the 10% discount coupon?

- If you open an account online, expect to receive your 10% coupon by email within two days of account opening.

- Are there any annual fees associated with the Burlington credit card?

- No, the Burlington credit card does not come with an annual fee, making it a budget-friendly option for frequent shoppers.

- Can I combine my reward certificates with other discounts or promotions?

- Generally, reward certificates cannot be combined with other offers or discounts. However, it’s always best to check with the store for specific terms and conditions.

- Is there a minimum purchase requirement to redeem reward certificates?

- Yes, reward certificates typically require a minimum purchase amount. Check the terms and conditions for details on redemption requirements.

Conclusion

Managing your Burlington Credit Card payments is crucial for maintaining financial health. By following these steps and tips, you can navigate the payment process with ease and confidence. Whether setting up automatic payments or making manual transactions, staying proactive ensures smooth operations and fosters a positive credit history.

Also read: Best App Uninstallers for Android

In conclusion, the Burlington credit card offers a mixed bag of perks and limitations. Whether it’s the right fit for you depends on your spending habits and shopping preferences. Keep these insights in mind as you weigh your options and embark on your credit card journey.

Comments 1