In today’s fast-paced world of electronic banking, understanding the nuances of routing numbers is essential for seamless financial transactions. Let’s delve into the realm of Capital One Bank routing numbers, demystifying their significance, variations, and implications for different types of transactions.

Unveiling Capital One Bank’s Unique Approach

Capital One Bank presents an intriguing case in the banking landscape with its approach to routing numbers. While many banks utilize a plethora of routing numbers corresponding to different states or regions, Capital One operates with just two routing numbers: 051405515 or 056073612. This streamlined approach is quite distinctive in an industry where complexity often reigns supreme.

| Transaction | Type of routing number | Capital One code |

|---|---|---|

|

Payments and debits between US accounts

|

ACH routing number

|

051405515-056073612

|

|

Wire payments between US accounts

|

Domestic wire transfer number

|

051405515-056073612

|

|

Wire payments to an international account

|

SWIFT code

|

NFBKUS33

|

Understanding the Role of Routing Numbers

What Exactly is a Routing Number?

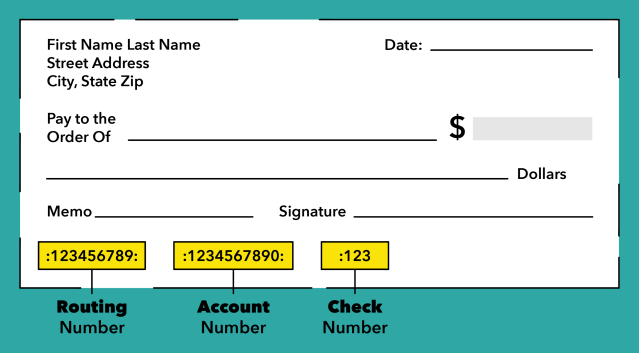

A routing number serves as a unique identifier for a bank within the broader financial network. Think of it as the bank’s “address,” facilitating the routing of funds to the correct destination, much like postal codes in conventional mail delivery systems.

Why Might a Bank Have Multiple Routing Numbers?

While the primary routing number remains consistent for incoming wire transfers, banks may employ additional routing numbers for various transaction types such as ACH transfers or direct deposits. These multiple routing numbers aid in efficient transaction processing and categorization.

The Significance of Region-Specific Routing Numbers

Physical checks often bear region-specific or branch-specific routing numbers. These localized routing numbers streamline the check-clearing process, ensuring prompt and accurate fund allocation to the intended accounts.

Navigating the International Landscape: SWIFT Codes

For international wire transfers, a different system comes into play: SWIFT codes. Capital One Bank‘s SWIFT Code is HIBKUS44. This alphanumeric code enables seamless international fund transfers, ensuring global connectivity for customers.

The Historical Context: Origins of Routing Numbers

The concept of routing numbers traces back to 1910, spearheaded by the American Bankers Association (ABA). These numeric identifiers were introduced to streamline the processing of checks, mitigating confusion and inefficiencies prevalent at the time.

Decoding Routing Numbers: What Do They Mean?

A typical bank routing number comprises a nine-digit sequence, each digit bearing specific significance:

| Digit Position | Significance |

|---|---|

| First two digits | Identify the clearing bank or credit union |

| Next two digits | Denote the bank’s processing center and location |

| Next four digits | Serve to identify the specific bank |

| Last digit | Functions as a check digit, validating the routing number |

Pro Tips for Navigating Routing Numbers

“Your bank’s routing number is like an address that tells other banks where to send money. You can usually find it on your checks, on your bank’s website, or by logging into your online banking account. Yes, some banks use different routing numbers for different types of transactions. For example, the routing number for a wire transfer might be different from the one you use for direct deposit. Always double-check to make sure you’re using the right one for your specific transaction type.” – Jeff Rose, CFP and founder of GoodFinancialCents.com

Frequently Asked Questions (FAQs)

- What are routing numbers used for? Routing numbers facilitate the routing of funds between financial institutions, ensuring accurate and efficient transaction processing.

- How can I find my Capital One Bank routing number? You can typically locate your routing number on your checks, through your bank’s website, or by accessing your online banking account.

- Why does Capital One Bank have only two routing numbers? Capital One’s streamlined approach simplifies transaction processing, minimizing complexity for customers and the bank alike.

- Do I need different routing numbers for different transaction types? Depending on the transaction type (e.g., wire transfer, direct deposit), you may need to use different routing numbers. Always verify the correct routing number for your specific transaction.

- Can I use the same routing number for international transactions? No, for international transactions, you’ll need to use a SWIFT code instead of a routing number.

- How do routing numbers enhance transaction security? Routing numbers ensure accurate fund allocation and facilitate the resolution of payment issues, bolstering the security and efficiency of financial transactions.

- Are routing numbers unique to each bank? Yes, routing numbers are unique identifiers assigned to each financial institution, akin to a digital fingerprint.

- Can routing numbers be changed? Yes, banks may change routing numbers due to mergers, acquisitions, or operational considerations. It’s essential to stay informed about any updates or changes to your bank’s routing number.

- What is the significance of the check digit in a routing number? The check digit serves as a validation mechanism, verifying the accuracy and integrity of the routing number.

- How do region-specific routing numbers impact transaction processing? Region-specific routing numbers streamline the check-clearing process, ensuring efficient fund allocation to local branches or regions.

Conclusion: Navigating the Financial Landscape with Confidence

In essence, understanding Capital One Bank routing numbers empowers customers to navigate the intricate terrain of electronic banking with confidence and clarity. By demystifying these numeric identifiers and their implications, we pave the way for seamless financial transactions, irrespective of geographical boundaries or transaction types. So whether you’re sending funds domestically or venturing into the realm of international transfers, armed with this knowledge, you can navigate the financial landscape with ease and assurance.

Comments 2