Welcome to our guide on increasing your American Express (Amex) credit limit! If you’re looking to boost your purchasing power and enhance your financial flexibility, you’re in the right place. In this comprehensive guide, we’ll delve into the ins and outs of Amex credit limit increases, providing you with actionable tips and expert advice to help you secure a higher credit limit.

Understanding the Importance of Credit Limit Increases

What is a Credit Limit? A credit limit is the maximum amount of money that a credit card issuer, such as American Express, allows you to borrow on your credit card account. It represents the upper boundary of your spending capacity and is determined by various factors, including your credit history, income, and existing debts.

Why Does Your Amex Credit Limit Matter? Your Amex credit limit plays a crucial role in your financial management. It determines how much you can charge to your credit card and influences your overall credit utilization ratio, which is a significant factor in calculating your credit score. Additionally, a higher credit limit provides you with greater purchasing power and can be particularly beneficial for making large purchases or handling unexpected expenses.

Boosting Your Credit Utilization Ratio: A higher credit limit can significantly improve your credit utilization ratio, a key factor in your credit score. Aim for a utilization ratio below 30% to showcase responsible credit use.

Increased Borrowing Capacity: More credit means more financial flexibility. Whether it’s for emergency expenses or big-ticket items, a higher limit provides a safety net when you need it most.

Perks and Rewards: Often, with increased credit limits, come additional benefits. Whether it’s exclusive access to rewards programs or promotional offers, the perks can be quite enticing.

Benefits of a Higher Credit Limit

| Benefit | Description |

|---|---|

| Improved Credit Utilization Ratio | Lower utilization can lead to a better credit score. |

| Increased Financial Flexibility | More room for purchases, emergency funds, and financial planning. |

| Access to More Perks | Higher limits often come with additional cardmember benefits. |

Evaluating Your Financial Situation

Before making your move, it’s crucial to take a hard look at your finances. Are you in a stable position to manage a higher limit? Here’s what to consider:

- Income vs. Expenses: Understand your monthly cash flow by subtracting your expenses from your income.

- Debt-to-Income Ratio: Aim for a ratio below 36% to maintain financial health.

- Credit Utilization: See if a higher limit could help lower your overall credit utilization.

Factors Influencing Amex Credit Limit Increases

Now that we’ve covered the basics, let’s explore the factors that influence Amex credit limit increases. Understanding these factors is essential for developing a strategic approach to maximizing your credit limit.

| Factors Influencing Amex Credit Limit Increases |

|---|

| 1. Payment History: Consistently paying your Amex bills on time demonstrates responsible financial behavior and may increase your chances of receiving a credit limit increase. |

| 2. Income: A higher income level signals greater financial stability and may make you eligible for a higher credit limit. Be sure to accurately report your income when applying for a credit limit increase. |

| 3. Credit Score: Your credit score is a reflection of your creditworthiness and plays a significant role in determining your eligibility for a credit limit increase. Aim to maintain a healthy credit score by managing your debts responsibly. |

| 4. Account Age: Long-standing Amex cardholders with a history of responsible credit card usage may be more likely to receive credit limit increases. |

| 5. Request Frequency: While it’s possible to request a credit limit increase from Amex, doing so too frequently may signal financial instability and could potentially harm your creditworthiness. Exercise discretion when requesting increases. |

List: Steps to Evaluate Financial Readiness

- Review monthly income and expenses.

- Calculate your debt-to-income ratio.

- Assess your credit utilization ratio.

- Consider upcoming financial needs or obligations.

Contacting American Express

Reaching Out: Whether through a phone call, online chat, or written letter, choose the method that best suits you. Be polite and prepared with your financial details.

Table: Methods of Contacting Amex

| Method | How to Proceed |

|---|---|

| Phone | Call the number on the back of your card. |

| Online Chat | Use the chat feature in your account portal. |

| Written Letter | Send a detailed request to their mailing address. |

Preparing Your Request

Gathering Information: Have your financial information at the ready. Know what you’re asking for and why. Highlight your responsible credit behavior and your reasons for needing an increase.

Crafting a Compelling Letter or Phone Script

Key Components: Be clear about your request, demonstrate your financial responsibility, and express your appreciation for Amex’s consideration. Here’s how to structure your communication for success.

Checklist for a Compelling Request

- Polite greeting and introduction

- Specific credit limit increase request

- Summary of financial responsibility

- Explanation of reasons for the increase

- Expression of loyalty to Amex

- Assurance of repayment capability

- Thankful closing remarks

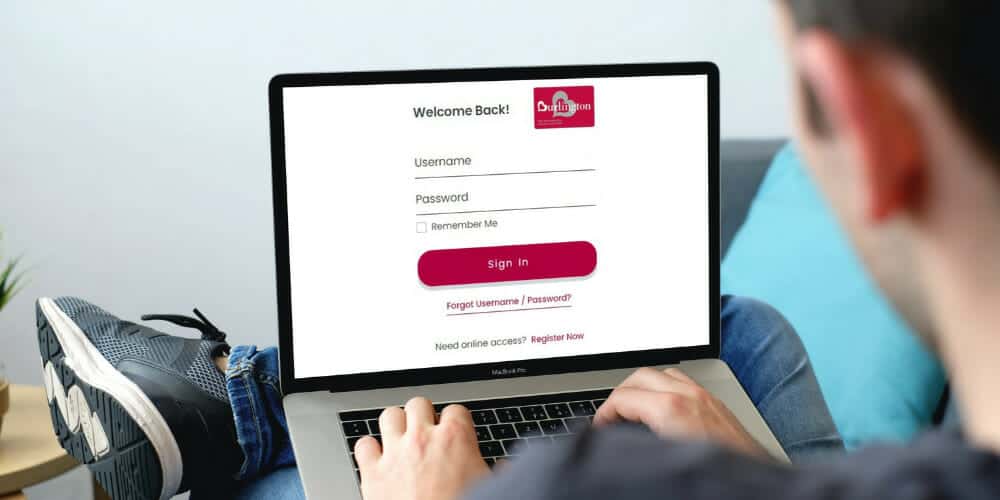

Submitting Your Request to American Express

Choose your submission method based on your preparedness and preference. Remember to keep a record of your communication for future reference.

Also read: Code 571

Following Up on Your Request

Patience and Persistence: Allow Amex some time to process your request but don’t hesitate to follow up if necessary. Checking your online account and making polite inquiries can help you stay informed.

Handling a Credit Limit Increase Denial

Don’t Lose Heart: If your request is denied, understand the reasons why and what steps you can take to improve your chances in the future.

If American Express denies your credit limit increase request, don’t be discouraged. Understanding the reasons for the denial can help you make the necessary adjustments to improve your chances in the future. Steps to consider include improving your credit history, increasing card usage responsibly, and updating your income information on the American Express website.

Tips for Responsible Credit Card Usage

Maintain Financial Health: Even with a higher limit, the key is to use your credit wisely. Stick to a budget, pay your bills on time, and keep your credit utilization low.

Frequently Asked Questions (FAQs)

1. How often can I request a credit limit increase from Amex? You can typically request a credit limit increase from Amex every six months. However, frequent requests may have a negative impact on your creditworthiness.

2. Will requesting a credit limit increase affect my credit score? In most cases, requesting a credit limit increase will result in a hard inquiry on your credit report, which may temporarily lower your credit score. However, if approved, the increase in available credit may ultimately have a positive effect on your credit utilization ratio and credit score.

3. Can I request a specific amount for my credit limit increase? While you can suggest a desired credit limit increase amount when submitting your request to Amex, the final decision is ultimately at the discretion of the credit card issuer.

4. How long does it take to receive a decision on a credit limit increase request? The timeframe for receiving a decision on a credit limit increase request can vary. In some cases, you may receive an immediate decision online, while in others, it may take several days for Amex to review your request.

5. What should I do if my credit limit increase request is denied? If your credit limit increase request is denied, don’t panic. Take the opportunity to review your financial situation and identify areas for improvement, such as paying down existing debts or increasing your income. You can also consider reaching out to Amex for feedback on why your request was denied and what steps you can take to increase your chances of approval in the future.

6. Does Amex automatically increase credit limits? While Amex may periodically review accounts for potential credit limit increases, there is no guarantee that they will do so. It’s essential to take proactive steps to demonstrate your creditworthiness and increase your chances of receiving a credit limit increase.

7. Can I request a credit limit increase for a specific purpose, such as financing a large purchase? While you can certainly request a credit limit increase to accommodate a specific financial need, such as financing a large purchase, Amex will evaluate your request based on your overall creditworthiness and financial circumstances.

8. Will a credit limit increase affect my ability to apply for additional credit cards or loans? A credit limit increase may affect your overall credit utilization ratio, which is a factor that lenders consider when evaluating your creditworthiness for new credit cards or loans. However, if managed responsibly, a higher credit limit can also demonstrate financial stability and may enhance your eligibility for future credit opportunities.

9. Can I request a credit limit increase if I’ve recently experienced a change in income? Yes, if you’ve experienced a significant increase in income since you initially applied for your Amex card, you can request a credit limit increase to reflect your improved financial circumstances. Be sure to provide accurate and up-to-date information about your income when submitting your request.

10. Are there any fees associated with requesting a credit limit increase from Amex? No, Amex typically does not charge a fee for requesting a credit limit increase. However, it’s essential to review your cardmember agreement or contact Amex directly to confirm the specific terms and conditions that apply to your account.

Also read: Lynskey bikes

Conclusion

Securing a credit limit increase with American Express is within reach if you approach the process with preparation and understanding. Use this guide as your roadmap to financial flexibility and success. Requesting a credit limit increase from American Express can be a beneficial financial strategy if done responsibly and with a clear understanding of your financial health and goals. Whether you choose to request an increase online or over the phone, make sure you’re prepared with all necessary information to support your request.