Planning for retirement can feel overwhelming, but it doesn’t have to be! With the right knowledge and strategies, you can set yourself up for a comfortable and secure future. One popular choice for retirement planning is the Merrill Edge 401k. In this comprehensive guide, we’ll dive deep into everything you need to know to make the most of your Merrill Edge 401k and maximize your retirement savings.

Key Takeaways:

- Contributing within limits: Maximizing contributions is crucial for building a solid retirement nest egg.

- Investing history: Manage your investments wisely to optimize growth.

- Employer matching: Take advantage of employer contributions to accelerate your savings.

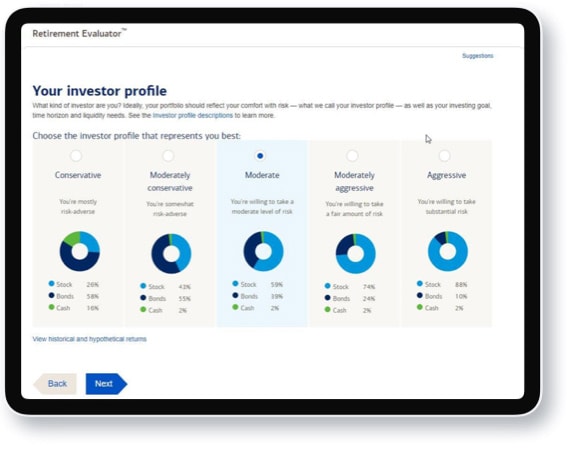

- Investment strategies: Consider your risk tolerance and retirement goals when choosing investments.

Retirement Solutions for Individual Investors

If you’re an individual investor looking to maximize your retirement savings, Merrill has you covered. Here’s what sets us apart:

| Feature | Benefits |

|---|---|

| Tailored Accounts | Find an account built to help you achieve your investing goals. |

| Investor Profile | Determine your investor profile and manage your retirement account accordingly. |

| Affordable Pricing | Enjoy straightforward pricing and affordable fully managed accounts. |

| Convenience | Manage your Merrill Investing and Bank of America banking accounts through a single, secure login. |

Retirement Solutions for Businesses

For entrepreneurs and sole proprietors, Merrill offers specialized retirement solutions designed to fit your unique needs:

| Feature | Benefits |

|---|---|

| Workplace Retirement Plans | Choose from SEP IRA, SIMPLE IRA, or an online 401(k) for your business. |

| Tax Advantages | Save money with tax advantages tailored to your business. |

| Personalized Options | Fit your budget with competitive pricing and get greater control over your plan. |

| Expert Assistance | Accomplish more with available specialists dedicated to your success. |

Choosing the Right Retirement Account

With so many options available, how do you know which retirement account is right for you? Let’s compare the features of Merrill’s retirement accounts to help you make an informed decision:

| Retirement Account | Eligibility | Contribution Limits | Tax Advantages |

|---|---|---|---|

| Traditional IRA | Anyone with earned income | $6,000 per year ($7,000 if 50+) | Tax-deferred growth |

| Roth IRA | Income limits apply | Same as Traditional IRA | Tax-free withdrawals in retirement |

| SEP IRA | Self-employed individuals | Up to 25% of compensation | Tax-deductible contributions |

| SIMPLE IRA | Small businesses | $13,500 per year ($16,500 if 50+) | Tax-deferred growth |

| 401(k) | Employer-sponsored plans | $19,500 per year ($26,000 if 50+) | Employer matching contributions, tax deferral |

Understanding Contribution Limits

When it comes to contributing to your Merrill Edge 401k, it’s essential to understand the contribution limits. These limits are influenced by various factors such as age, income, and federal regulations. Contributing as much as possible within these limits is key to maximizing your retirement savings. Let’s break down the contribution limits for a clearer picture:

| Age Group | Contribution Limit (2022) | Catch-up Contributions (if over 50) |

|---|---|---|

| Under 50 | $20,500 | |

| Over 50 | $27,000 | Additional $6,500 |

Exceeding these limits can lead to penalties and tax consequences, so it’s crucial to stay within them while maximizing your contributions.

Importance of Investing History

Understanding your investing history within your Merrill Edge 401k is vital for optimizing growth. By analyzing past performance, you can identify trends, risks, and opportunities for improvement. Let’s explore the benefits and considerations of evaluating your investing history:

Benefits:

- Identify growth opportunities: Spot investments with consistent growth potential.

- Manage risk: Adjust your portfolio to maintain a balanced risk-to-reward ratio.

- Maximize returns: Reallocation based on past performance can boost savings.

- Stay informed: Regular reviews keep you informed and adaptable to market changes.

Tips for Maximizing Contributions

Maximizing your Merrill Edge 401k contributions is essential for securing your retirement. Here are some tips to help you make the most of your contributions:

| Tip | Description |

|---|---|

| Contribute as much as possible | Maximize your contributions for optimal tax benefits. |

| Take advantage of employer matching | Ensure you receive the full employer match for added savings. |

| Consider Roth 401k contributions | Evaluate if Roth contributions align with your retirement goals for tax diversification. |

| Create an emergency fund | Establish a safety net to prevent early withdrawals and preserve retirement savings. |

Considerations for Investment Options

When planning your Merrill Edge 401k investments, consider your risk tolerance and goals. Here are some available options and their characteristics:

| Investment Option | Benefits | Risk Level |

|---|---|---|

| Stocks | Potential for high returns | High |

| Bonds | Steady income | Low to Medium |

| Mutual Funds | Professional management and diversification | Varies |

| Target-Date Funds | Automatic asset allocation adjustment | Medium to High |

Your investment decisions should align with your risk tolerance and time horizon. Consulting with a financial advisor can provide personalized guidance.

Leveraging Employer Matching Contributions

Employer matching contributions are a valuable component of Merrill Edge 401k plans. By understanding and maximizing these contributions, you can accelerate your retirement savings. Here’s what to consider:

- Matching percentage: Contribute enough to receive the full employer match.

- Maximum matching limit: Ensure you reach the maximum limit for maximum benefits.

- Vesting period: Understand the vesting schedule to gain full ownership of matched contributions.

Importance of Merrill Edge 401k Retirement Benefits

Participating in a Merrill Edge 401k plan offers numerous retirement benefits. Understanding these benefits is crucial for effective retirement planning. Let’s explore them:

- Tax advantages: Contributions are tax-deferred, reducing current tax liability and allowing tax-free growth.

- Potential growth: Investment options provide opportunities for portfolio growth over time.

- Secure retirement: Consistent contributions and employer matching lead to a comfortable retirement.

- Employee benefits: Merrill Edge 401k is often a vital part of an employee benefits package, demonstrating employer commitment to financial well-being.

Merrill Edge Self-Directed

One of the hallmarks of Merrill Edge Self-Directed is its seamless integration with Bank of America. This integration isn’t just a mere convenience; it’s a game-changer. With a single login, investors can effortlessly access both their Bank of America accounts and Merrill Edge accounts. This streamlined approach not only saves time but also provides a holistic view of one’s financial landscape.

| Integration Benefits | Details |

|---|---|

| Single login for Bank of America and Merrill Edge | Effortlessly manage both accounts with a single set of credentials, simplifying the overall user experience. |

| Comprehensive view of finances | Gain insights into banking activities and investment portfolios simultaneously, empowering better financial decision-making. |

Merrill Edge Self-Directed: A Snapshot

Before diving headfirst into the world of online investing, let’s take a moment to examine the key features and offerings of Merrill Edge Self-Directed:

| Key Features | Details |

|---|---|

| Account Minimum | $0 |

| Stock Trading Costs | $0 |

| Options Trades | $0 + $0.65 per contract |

| Account Fees (Annual, Transfer, Closing, Inactivity) | No annual, inactivity, or partial transfer fees; $49.95 full outgoing account transfer fee. |

| Number of No-Transaction-Fee Mutual Funds | 819 |

| Tradable Securities | Stocks, Bonds, Mutual Funds, ETFs, Options |

| Interest Rate on Uninvested Cash | 0.01% |

| Trading Platform | Three trading platforms: Full site HTML experience, Merrill Edge Mobile App (iOS and Android), Merrill Edge MarketPro. |

| Mobile App | Advanced features mimic a desktop trading platform; 24/7 customer support; Some mixed reviews. |

| Research and Data | Research, ratings, and reports from providers like Bank of America, Morningstar, and CFRA. |

| Customer Support Options | 24/7 phone, chat, email support; In-person appointments available during Bank of America branch open hours. |

Conclusion: Secure Your Future with Merrill Edge 401k

Retirement planning doesn’t have to be daunting. With Merrill Edge 401k, you have the tools and resources to build a secure financial future. By understanding contribution limits, managing investments wisely, and leveraging employer matching contributions, you can maximize your retirement savings and enjoy a comfortable retirement. Start planning today and make the most out of your Merrill Edge 401k!