Welcome to our detailed exploration of the Academy credit card! In this comprehensive guide, we’ll delve into every nook and cranny of this credit card offering from Academy, the renowned sports and outdoor retailer. Strap in as we uncover the perks, drawbacks, and everything in between, helping you make an informed decision about whether this card aligns with your financial goals and shopping habits.

Introducing the Academy Credit Card

Let’s kick things off with a bird’s eye view of what the Academy credit card brings to the table. As a dedicated shopper at Academy Sports + Outdoors, you’re likely enticed by the promise of a 5% discount on all your purchases, both in-store and online. It’s a straightforward deal – no convoluted rewards program here. But as with any financial product, there’s more to the story than meets the eye.

Card Variants

Depending on your creditworthiness, you may receive either the Academy Sports + Outdoors Visa Signature or the Academy Sports + Outdoors Visa.

Understanding the Academy Credit Card

Before we delve into payment methods, let’s grasp the essence of the Academy Credit Card. This card, issued by Academy Bank, is tailored for Academy Sports + Outdoors enthusiasts, providing exclusive perks and rewards for cardholders. Here’s what you need to know:

- Rewards Program: Earn Academy Rewards Points with every eligible purchase, redeemable for discounts and exclusive offers.

- Special Financing Options: Qualifying purchases may benefit from interest-free financing within specified promotional periods, easing the burden of larger expenses.

- Exclusive Offers and Discounts: Stay in the loop with member-only deals and promotions, ensuring you never miss out on savings opportunities.

academy credit card payment

The Pros and Cons

Before we dive deeper, let’s weigh the pros and cons of the Academy credit card.

| Pros | Cons |

|---|---|

| 5% discount on Academy purchases | Closed-loop card – restricted to Academy only |

| Free shipping for online orders | Limited sign-up offer compared to other cards |

| No expiration on rewards | High APR for purchases |

| Free returns for online purchases |

As we can see, there are both enticing perks and potential drawbacks to consider. Let’s dissect each aspect further.

The 5% Discount: A Simple Pleasure

One of the most alluring aspects of the Academy credit card is its simplicity. No complex rewards programs with expiration dates – just a straightforward 5% discount at checkout. Whether you’re stocking up on fitness equipment or gearing up for your next outdoor adventure, this discount applies across the board.

However, it’s essential to note that certain items, such as gift cards and in-store services, are excluded from this discount. Additionally, if you split your payment methods for an online purchase, you forfeit the 5% discount.

How to Apply for a Academy Sports Credit Card?

Before delving into the application process, ensure you meet the following requirements:

- Age: Applicants must be 18 years or older.

- Residency: Must be a US citizen or resident.

- Identification: Possess a Social Security number and government-approved ID.

- Income: Have a verifiable source of income.

- Credit Score: Maintain a good credit score.

Once you’ve met these criteria, follow these simple steps to apply:

- Visit the Comenity Bank Academy credit card portal.

- Navigate to the Academy Credit card section and click on Apply Now.

- Fill out the application form with your personal and financial details.

- Review the terms and conditions, then submit your application.

After submission, expect a 7-day wait for approval. Upon approval, you’ll receive your card within 7-10 business days, ready to unlock a world of savings.

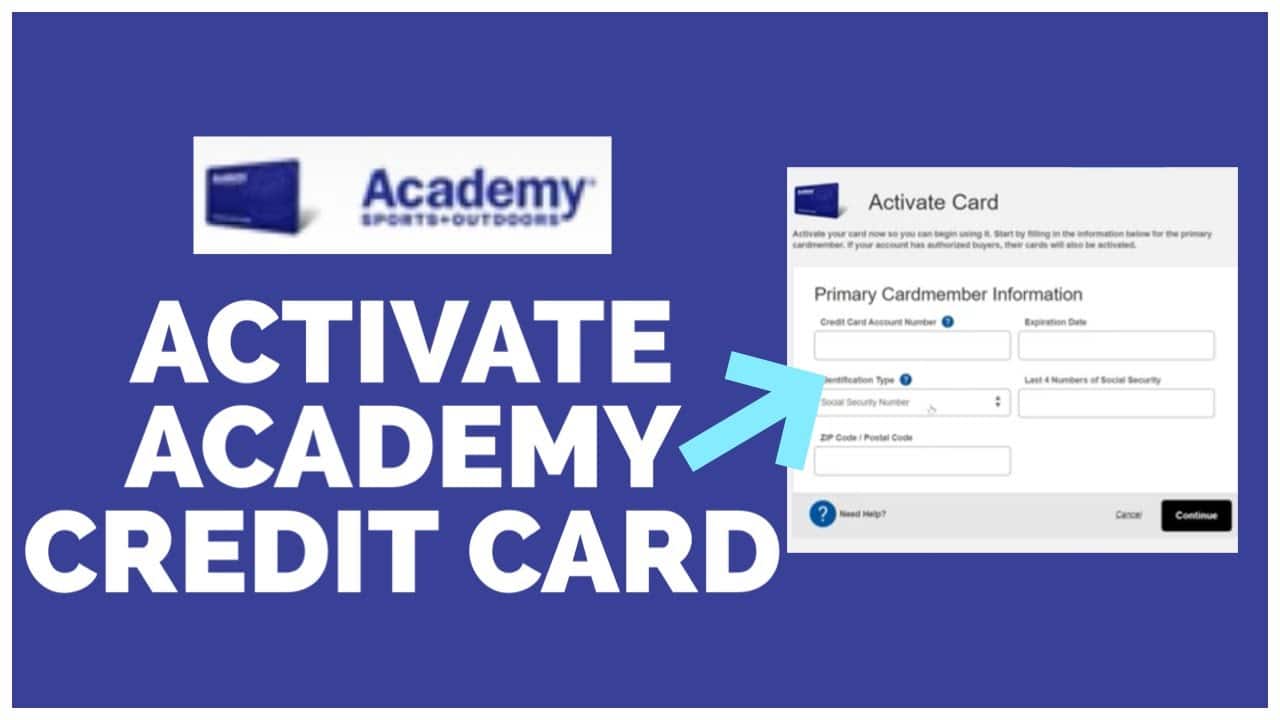

How to Activate an Academy Credit Card?

Upon qualifying for the Academy credit card, you’ll receive activation details via email. Activate your card effortlessly through either of the following methods:

Online Activation:

- Visit the comenity.net/academy/activate portal.

- Enter your card details and personal information.

- Follow the on-screen prompts to complete activation.

Phone Activation:

- Call 1-877-321-8509 to connect with the card activation department.

- Provide your details and follow the instructions to activate your card.

How to Log in to Comenity Academy Sports Credit Card?

Once activated, accessing your Academy credit card account is a breeze. Follow these steps to log in:

- Visit the Academy Sports +Outdoors official website.

- Click on Academy Credit Card at the bottom of the homepage.

- Select Sign-in and enter your credentials.

- Click Secure Login to access your account.

Ensure you have a stable internet connection and an activated Academy Sports+Outdoors credit card before proceeding.

How to Recover Forgotten Academy CC Payment Login Password?

Forgot your login credentials? No worries! Follow these steps to reset your password:

- Visit comenity.net/academy.

- Click on Academy Credit Card and then Sign-in.

- Select Forgot Password and enter your username and last four digits of your SSN.

- Follow the prompts to reset your password.

Now that you’re equipped with the knowledge to manage your Academy credit card, let’s explore the various payment methods available to you.

Available Payment Methods

When it comes to paying your Academy Credit Card, flexibility is key. Here are the convenient payment methods at your disposal:

| Payment Method | Description |

|---|---|

| Online Payment | Quick and secure payments via the Academy Bank website, with options for recurring payments. |

| Payment by Phone | Make payments over the phone by contacting the Academy Credit Card customer service line. |

| Payment by Mail | Traditional method of sending payments through the mail using the provided envelope. |

| In-Store Payment | Make payments in person at any Academy Sports + Outdoors store location. |

Online Payment

Embrace the ease of online payments for your Academy Credit Card:

- Visit the Academy Bank Website: Head to the official Academy Bank website and navigate to the “Credit Cards” or “Manage Your Account” section.

- Log in: Access your account by entering your credentials or register if you’re a new user.

- Access Payment Section: Locate the “Payment” or “Pay Bill” section within your account.

- Choose Payment Method: Opt for bank account or debit card payment and input the required details.

- Enter Payment Amount: Specify the payment amount, whether minimum, full balance, or custom.

- Schedule Recurring Payments: Set up automatic payments for added convenience.

- Review and Submit: Double-check payment details before submitting for immediate processing.

Payment by Phone

Prefer a personal touch? Here’s how to make a payment over the phone:

- Gather Information: Have your Academy Credit Card details and banking information on hand.

- Find Customer Service Number: Locate the customer service number on your card or billing statement.

- Follow Prompts: Navigate through the automated prompts to reach the payment section.

- Provide Payment Details: Input necessary information, including payment amount and method.

- Review and Confirm: Verify payment details and confirm to complete the transaction.

Payment by Mail

For those who prefer the traditional route, follow these steps for mailing your payment:

- Prepare Payment: Use the payment slip from your statement or write a check/money order payable to Academy Credit Card.

- Enclose Payment: Place payment and slip in provided envelope and seal securely.

- Include Account Information: Write your Academy Credit Card account number on the payment slip or memo line.

- Mail Payment: Send to the specified address on your statement, allowing ample time for processing.

In-Store Payment Options

Get a personal touch by making payments in person:

- Visit a Store: Find a nearby Academy Sports + Outdoors location.

- Bring Your Card: Don’t forget your Academy Credit Card.

- Head to Customer Service: Approach the customer service desk for assistance.

- Provide Information: Supply necessary details and specify payment amount.

- Make Payment: Complete the transaction and receive a receipt for your records.

Automatic Payment Setup

Streamline your payments with automatic scheduling:

- Log In to Your Account: Access your Academy Credit Card account online.

- Navigate to Payment Section: Find the option to set up automatic payments.

- Choose Frequency: Select monthly, bi-monthly, or semi-monthly payments.

- Specify Amount: Set the desired payment amount for automatic deduction.

- Select Payment Method: Enter details for bank account or debit card.

- Review and Confirm: Double-check details before confirming setup.

Late Payment Options

Life happens, but here’s how to address a late payment:

- Review Statement: Understand fees and penalties associated with late payments.

- Contact Customer Service: Reach out to explain your situation and explore solutions.

- Explain Circumstances: Be honest about reasons for the late payment.

- Request Extension or Arrangement: Ask about options for extending payment deadlines or arranging installments.

- Pay Promptly: Aim to make the payment as soon as possible to minimize further consequences.

- Learn and Plan: Evaluate your financial habits to avoid future late payments.

Restricted Usage: Academy Exclusive

While the 5% discount may sound enticing, it comes with a caveat – the closed-loop nature of the Academy credit card. Unlike general cash-back cards, which offer flexibility across various retailers, the Academy card can only be used for purchases at Academy Sports + Outdoors. This limitation might cramp your style if you prefer shopping around for the best deals.

Lackluster Sign-Up Offer

Another aspect to consider is the sign-up offer for new cardholders. While you’ll receive a $15 discount off your first purchase at Academy, it pales in comparison to sign-up bonuses offered by other credit cards. For instance, the Chase Freedom Flex℠ boasts a $200 bonus after meeting a minimum spending threshold, making it a more enticing offer for many consumers.

Sky-High APR: Proceed with Caution

If you’re considering carrying a balance on your card, brace yourself for the high APR associated with the Academy credit card. As of August 2023, the APR for purchases stands at a staggering 31.99%. This rate far exceeds the industry average and could quickly balloon your debt if left unchecked.

Free Shipping and Returns: A Silver Lining

Amidst the drawbacks, there are some silver linings to be found. Cardholders enjoy free shipping on all online orders totaling $15 or more, making it convenient to shop from the comfort of home. Additionally, Academy offers free returns for online purchases, either via prepaid FedEx shipping labels or in-store returns.

Is the Academy Credit Card Right for You?

Now that we’ve dissected the Academy credit card from every angle, it’s time to address the million-dollar question – is it worth it? The answer ultimately depends on your shopping habits, financial goals, and tolerance for restrictions.

If you’re a loyal Academy shopper who values simplicity and enjoys the convenience of online shopping, the 5% discount and free shipping may hold significant appeal. However, if you crave flexibility, prefer a more robust sign-up offer, or anticipate carrying a balance, you may want to explore alternative credit card options.

At the end of the day, knowledge is power. By arming yourself with a thorough understanding of the Academy credit card’s features and limitations, you can make an informed decision that aligns with your unique needs and preferences.

Frequently Asked Questions

- Can I use the Academy credit card anywhere?

- No, the Academy credit card is limited to purchases at Academy Sports + Outdoors stores and online.

- Does the 5% discount apply to all purchases?

- The 5% discount applies to most purchases but excludes certain items like gift cards and in-store services.

- What is the APR for the Academy credit card?

- As of August 2023, the APR for purchases on the Academy credit card is 31.99%.

- Are there any fees associated with the card?

- The Academy credit card may incur fees such as late payment fees and returned payment fees. Be sure to review the terms and conditions for full details.

- Can I combine the $15 sign-up discount with the 5% discount?

- No, the $15 sign-up discount cannot be combined with the 5% discount on purchases.

- Is there a minimum spending requirement to qualify for the sign-up discount?

- Yes, you must make your first purchase in the same shopping session as your card approval to receive the $15 discount.

- How do I initiate a return for an online purchase?

- You can initiate a return through the Academy website and receive a prepaid FedEx shipping label or return the item to a retail store.

- Does the card offer any additional perks or benefits?

- While the primary benefits are the 5% discount and free shipping, be sure to review the card’s terms and conditions for any additional perks.

- Can I earn rewards points with the Academy credit card?

- The Academy credit card does not offer rewards points; instead, it provides a straightforward 5% discount on eligible purchases.

- Are there any restrictions on using the card for online purchases?

- The card can be used for online purchases at Academy.com, subject to the terms and conditions outlined by the retailer.

Conclusion

In conclusion, the Academy Sports + Outdoors credit card offers a straightforward 5% discount on purchases, along with free shipping for online orders. However, its closed-loop nature, limited sign-up offer, and high APR may give some consumers pause. Ultimately, whether this card is right for you depends on your individual preferences and priorities. As always, it’s essential to conduct thorough research and carefully consider your options before committing to any financial product.

Comments 3