Welcome to our detailed guide on IRS Code 806 and its implications for your tax transcript. In this article, we will delve into the intricacies of this code, explaining its meaning, where to find it on your tax transcript, and what actions you should take if it appears. Whether you’re a seasoned taxpayer or just starting to navigate the complexities of the tax system, understanding Code 806 is crucial for ensuring accuracy in your tax filings and refunds.

What is IRS Code 806?

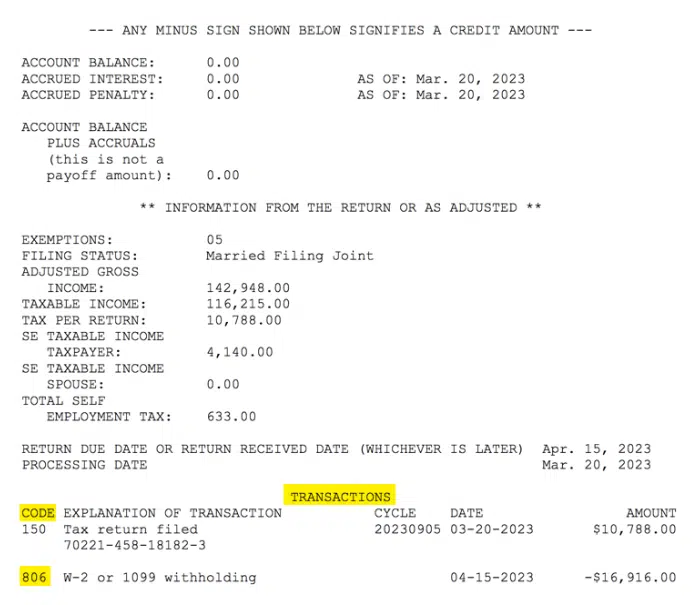

Now, let’s focus on IRS Code 806. This code, officially titled “Credit for Withheld Taxes and Excess FICA,” plays a significant role in your tax transcript. When you encounter Code 806 on your tax transcript, it indicates the amount of federal taxes and FICA taxes withheld by your employer(s) throughout the tax year.

Key Points:

- IRS Code 806 signifies the Credit for Withheld Taxes and Excess FICA.

- It represents the amount of federal taxes and FICA taxes withheld by employers.

Also read: IRS Code 571

What is a Tax Transcript?

Before we delve into the specifics of IRS Code 806, let’s first clarify what a tax transcript is. An IRS tax transcript is a comprehensive document that provides a detailed overview of your tax return. It includes transaction codes and line items relevant to your tax filing, such as income, deductions, and credits. Tax transcripts are invaluable tools for verifying the accuracy of your tax return and can be obtained for free from the IRS for the current tax year and the previous three years.

Key Points:

- IRS tax transcripts are essential for verifying the accuracy of tax returns.

- They contain transaction codes and line items relevant to tax filings.

Understanding Transaction Codes

Central to the tax transcript are transaction codes (TC), which are three-digit codes that signify specific actions or events in the processing of your tax return. These codes are crucial for understanding the status of your tax filing and identifying any discrepancies or issues that may arise during processing.

Types of IRS Transcripts

There are several types of IRS transcripts, each serving a specific purpose:

| Transcript Type | Purpose |

|---|---|

| Tax Return Transcript | Summarizes filed tax return information. |

| Account Transcript | Provides a comprehensive overview of the taxpayer’s account. |

| Wage and Income Transcript | Includes reported income details useful for income verification. |

Understanding IRS Code 806

Deciphering Code 806

Code 806 on an IRS Transcript indicates an adjustment made by the IRS to the taxpayer’s account. While it signifies a change, the specific details behind the adjustment are not immediately apparent.

Possible Explanations for Code 806

Some common explanations for Code 806 include:

- Mathematical errors correction

- Addressing missing information

- Adjusting deductions or credits

- Modifying reported income

- Result of an IRS audit or examination

Impact and Consequences of Code 806

Potential Effects

The presence of Code 806 can lead to various consequences, including:

- Additional tax liabilities

- Reduction in expected refunds

- Imposition of penalties and interest

- Extended audit or examination process

- Implications for future tax filings

Resolving Issues Related to Code 806

Steps to Take

If you encounter Code 806 on your IRS Transcript, consider the following steps:

- Thorough Review: Carefully examine the transcript to understand the nature of the adjustment.

- Seek Professional Guidance: Consult with a tax professional to assess the implications and determine the appropriate course of action.

- Gather Documentation: Collect relevant records and documents to support your case.

- Respond Promptly: Address any notices or correspondence from the IRS promptly to avoid escalation.

- Consider Audit Reconsideration: If necessary, request an Audit Reconsideration to challenge the adjustment.

- Explore Payment Options: Explore available payment options if additional tax liabilities arise.

- Maintain Documentation: Keep copies of all correspondence and documentation for future reference.

Also read: Burlington Credit Card

Conclusion

Dealing with Code 806 on an IRS Transcript can be complex, but understanding its implications is essential for resolving issues effectively. By taking proactive steps, seeking professional guidance, and maintaining clear communication with the IRS, taxpayers can navigate through the process with confidence.

Remember, timely action and informed decision-making are key to addressing Code 806 and ensuring compliance with tax laws. For personalized assistance tailored to your specific situation, consult with a qualified tax professional.

10 Questions and Answers Related to IRS Code 806:

- What does Code 806 on an IRS Transcript signify?

- Code 806 indicates an adjustment made by the IRS to the taxpayer’s account.

- What are some common explanations for Code 806?

- Common explanations include correcting mathematical errors, addressing missing information, adjusting deductions or credits, modifying reported income, or as a result of an IRS audit.

- How can Code 806 impact taxpayers?

- Code 806 can lead to additional tax liabilities, reduction in refunds, penalties, interest, extended audit processes, and implications for future tax filings.

- What steps should taxpayers take upon encountering Code 806?

- Taxpayers should review the transcript, seek professional guidance, gather documentation, respond promptly to IRS notices, consider audit reconsideration if necessary, explore payment options, and maintain documentation.

- Can taxpayers challenge Code 806 adjustments?

- Yes, taxpayers have the option to request an Audit Reconsideration to challenge the adjustment.

- What documents should taxpayers gather to support their case?

- Taxpayers should collect relevant records, receipts, and documentation related to the adjustment made by the IRS.

- How important is it to respond promptly to IRS notices?

- Responding promptly to IRS notices is crucial to avoid escalation of the situation and potential consequences.

- What payment options are available to taxpayers with additional tax liabilities?

- Taxpayers can explore installment agreements or other arrangements offered by the IRS to manage the owed amount.

- Why is maintaining documentation important throughout the process?

- Maintaining documentation serves as evidence and support for the taxpayer’s case in case of any future inquiries or disputes.

- Who should taxpayers consult for personalized advice and guidance?

- Taxpayers should consult with a qualified tax professional for personalized assistance tailored to their specific situation.

Also read: How To Get An American Express Credit Limit Increase

Comments 1