Welcome to the intricate world of tax transcripts! If you’ve ever tangled with the Internal Revenue Service (IRS), chances are you’ve encountered the enigmatic term “IRS transcript.” These documents hold the keys to understanding your tax-related history, offering a detailed glimpse into your financial dealings with the IRS. Among the myriad of codes that adorn these transcripts, one stands out: Code 571.

In this comprehensive guide, we’ll embark on a journey to demystify Code 571 and shed light on its significance, implications, and steps for resolution. Whether you’re a seasoned taxpayer or facing this code for the first time, buckle up as we navigate through the complexities of IRS transcripts and uncover the secrets behind Code 571.

Understanding IRS Transcripts

Before delving into the specifics of Code 571, let’s lay the groundwork by understanding the essence of IRS transcripts. These transcripts serve as a meticulous record of your tax history, meticulously documenting various aspects of your tax returns, including income, deductions, payments, and any adjustments made by the IRS. They play a crucial role in verifying the accuracy of tax filings and resolving disputes with the IRS.

IRS Notices: What You Need to Know

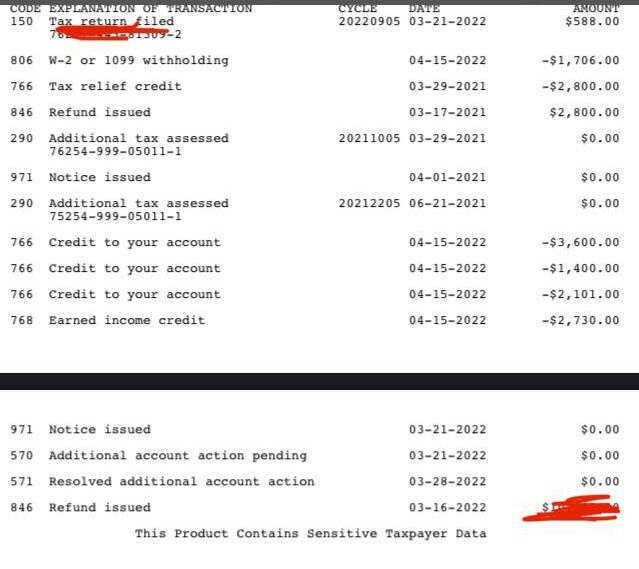

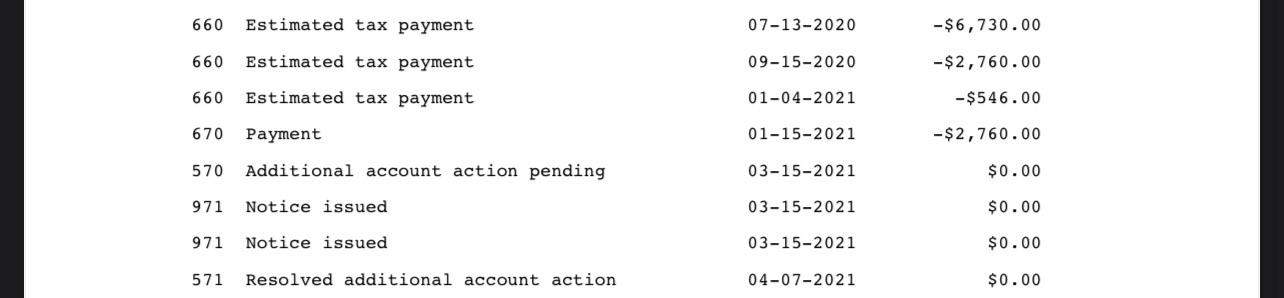

When the IRS detects an issue with your tax return, it may freeze your account and post transaction codes like 570 and 571 on your tax account transcript. Unfortunately, these transcripts don’t always provide detailed explanations for the freeze, leaving taxpayers in the dark about the underlying reasons.

Here’s what you should know about IRS notices and transaction codes:

| Key Points about IRS Notices |

|---|

| Lack of detailed explanations on tax account transcripts |

| Receipt of notices (Code 971) indicating further action required |

| Complexities in resolving issues leading to uncertain timelines |

Types of IRS Transcripts

To comprehend the intricacies of IRS transcripts, it’s essential to familiarize ourselves with the different types:

| Type of Transcript | Description |

|---|---|

| Tax Return Transcript | Provides information from your original tax return, including adjusted gross income (AGI) and filing status. |

| Account Transcript | Offers a detailed overview of your tax account, including adjustments made by the IRS, payments, and penalties. |

| Record of Account Transcript | Combines information from both tax return and account transcripts, providing a comprehensive tax account history. |

| Wage and Income Transcript | Furnishes details of income from various sources, such as employers and financial institutions. |

Understanding these distinctions is paramount, as each type serves a specific purpose and offers valuable insights into your tax situation.

What Is Code 571 on an IRS Transcript?

Deciphering the Enigma

Code 571 is a conspicuous presence on IRS transcripts, often signaling a freeze on your tax account. This freeze, denoted by Code 571, halts any further processing or actions related to that specific tax period. While its appearance may evoke anxiety, it’s crucial to decipher its implications and take appropriate measures to address it effectively.

Variations of Code 571

Code 571 manifests in various iterations, each bearing distinct implications:

| Code Variant | Description |

|---|---|

| 571A | Signifies a manual hold placed by the IRS, typically necessitating additional information or clarification. |

| 571B | Indicates an outstanding balance on your tax account, prompting a freeze until the balance is resolved. |

| 571C | Flags potential fraud or identity theft concerns, prompting protective measures while the IRS investigates. |

These variations underscore the multifaceted nature of Code 571 and its diverse implications for taxpayers.

Purpose of Code 571

Safeguarding Taxpayers’ Interests

The overarching purpose of Code 571 is twofold: to inform taxpayers of a freeze on their tax account and to safeguard against potential risks. Let’s delve deeper into its underlying objectives:

- Preventing Further Actions: Code 571 serves as a deterrent against unauthorized actions on your tax account, ensuring that no further processing occurs until the freeze is resolved.

- Protection Against Fraud: By imposing a freeze, Code 571 shields taxpayers from potential fraud or identity theft, providing a crucial layer of security.

- Ensuring Accuracy: The freeze facilitated by Code 571 allows for thorough review and resolution of discrepancies, thereby upholding the accuracy of tax records.

- Facilitating Audits: In cases of audits or examinations, Code 571 facilitates a comprehensive review process, maintaining integrity and accuracy.

Understanding these purposes elucidates the rationale behind Code 571 and underscores its significance in the realm of tax compliance.

Explanation of Code 571

Demystifying the Freeze

At its core, Code 571 signifies a freeze initiated by the IRS, necessitating a clear understanding to navigate its implications effectively:

- Manual Hold (571A): Indicates a manual freeze, often requiring additional information or clarification from taxpayers.

- Outstanding Balance (571B): Flags an unresolved balance, prompting a freeze until payment or arrangement is made.

- Fraud or Identity Theft (571C): Alerts to potential fraudulent activity, prompting protective measures while investigations ensue.

Understanding these nuances empowers taxpayers to address Code 571 with confidence and clarity.

Possible Implications of Code 571

Navigating the Impact

Code 571 exerts diverse implications on taxpayers’ financial landscape, necessitating a nuanced approach to resolution:

- Delay in Refunds: Freezes imposed by Code 571 can delay tax refunds until the freeze is resolved, impacting taxpayers’ financial liquidity.

- Suspension of Collection Actions: For those with outstanding balances, Code 571 provides temporary respite from collection measures until resolution.

- Halt on Audits or Examinations: Freeze initiated by Code 571 suspends audit processes, offering temporary relief from scrutiny and demands.

- Enhanced Personal Security: In cases of suspected fraud or identity theft, Code 571 safeguards taxpayers’ personal and financial information.

Understanding these implications equips taxpayers to navigate the challenges posed by Code 571 with resilience and resolve.

How to Address Code 571 on an IRS Transcript

Charting the Course of Action

Confronting Code 571 demands proactive steps to resolve the freeze and mitigate its impact:

- Contact the IRS: Initiate communication with the IRS to glean insights into the freeze’s nature and receive tailored guidance on resolution.

- Provide Documentation: Furnish any required documentation promptly, facilitating a swift resolution of the freeze.

- Resolve Outstanding Balances: Address any outstanding balances promptly, either through payment or negotiation with the IRS.

- Report Fraud or Identity Theft: Promptly report instances of suspected fraud or identity theft to the IRS, initiating protective measures.

- Adhere to IRS Guidance: Follow IRS instructions diligently, ensuring compliance with procedural requirements for freeze resolution.

- Seek Professional Assistance: Consider engaging a tax professional for expert guidance and support in navigating the resolution process effectively.

By adhering to these steps, taxpayers can navigate the labyrinth of Code 571 with clarity and confidence, paving the way for a swift resolution.

What is Tax Code 570?

Tax Codes 571 and 572 signify the resolution of TC 570 issues, indicating that the freeze on your return processing has been lifted, or additional account actions have been resolved.

Tax Code 570 signifies a hold on your tax return, indicating that it’s undergoing additional review by the IRS. This hold halts further processing, including refund payments, until the underlying issues are resolved. Essentially, it’s a red flag that prompts manual intervention to address discrepancies or errors detected in your return.

Why Do You See Code 570 on Your Tax Transcript?

There are various reasons why TC 570 may appear on your IRS transcript. Common triggers include:

| Potential Causes of Code 570 |

|---|

| Mismatched wage income reported by your employer |

| Claims for injured spouse status |

| Identity verification requirements |

| Reconciliation discrepancies in claimed tax credits |

These issues often necessitate manual review and verification by the IRS, leading to the issuance of TC 570 on your transcript.

Resolving TC 570: Insights and Solutions

Automatic Resolution via TC 971 Notice

Following additional reviews, the IRS may autonomously resolve TC 570 errors without requiring further action from you. In such cases, your return will be released for processing, including the disbursement of refunds.

However, if additional information is needed to address the issue, the IRS will send a notice (TC 971) detailing the discrepancy and outlining your next steps.

| Steps to Resolve TC 570 |

|---|

| Await IRS resolution or notice (TC 971) |

| Provide requested information promptly, if required |

| Review notice for guidance on next steps |

Interpreting Amounts Against Code 570

The monetary amounts displayed alongside code 570 on your transcript provide crucial insights into the status of your return:

- $0 Amount: Indicates that your return is still under review, with no monetary implications yet.

- Positive Amount: Suggests an IRS adjustment to your return, potentially resulting in a delay in refund processing.

How to Avoid Seeing IRS Code 571 on a Tax Account Transcript

Prevention is key when it comes to IRS Code 571. By ensuring accuracy in your tax return and promptly addressing any issues with the IRS, you can minimize the likelihood of encountering processing delays and account freezes.

Here are some proactive steps to avoid IRS Code 571:

- Double-check all information on your tax return for accuracy.

- Verify your eligibility for claimed tax credits.

- Promptly respond to any notices or communications from the IRS.

- Contact the IRS if you suspect an error or discrepancy in your account status.

By following these guidelines, you can streamline the tax return process and minimize the risk of encountering IRS Code 571 or related transaction codes.

Conclusion

Navigating the Tax Terrain

In the intricate tapestry of tax transcripts, Code 571 emerges as a pivotal marker, signaling freezes with diverse implications. By unraveling the mysteries surrounding Code 571 and adopting a proactive approach to resolution, taxpayers can navigate the tax terrain with resilience and clarity.

Taxes, albeit complex, need not be daunting. Armed with knowledge, determination, and the right guidance, taxpayers can overcome challenges, ensuring the smooth processing of their tax accounts and safeguarding their financial well-being.

So, the next time Code 571 graces your IRS transcript, approach it not with trepidation, but with resolve. For within its enigmatic confines lie opportunities for empowerment and financial stewardship.

Frequently Asked Questions (FAQs)

- What triggers Code 571 on an IRS transcript?

- Code 571 may be triggered by various factors, including outstanding balances, audits, discrepancies, or suspected fraud.

- How long does it take to resolve Code 571?

- The resolution timeline for Code 571 varies depending on individual circumstances and the nature of the freeze. Prompt action and compliance with IRS requirements can expedite the process.

- Can I dispute Code 571 on my IRS transcript?

- Taxpayers have the right to dispute Code 571 and seek resolution through appropriate channels. Consulting the IRS or a tax professional can provide guidance on dispute resolution procedures.

- Will Code 571 affect my credit score?

- While Code 571 itself does not directly impact credit scores, unresolved tax issues may have indirect implications on financial standing. Prompt resolution is advisable to mitigate potential impacts.

- Can I request a transcript to check for Code 571?

- Taxpayers can request IRS transcripts to review their tax history, including the presence of Code 571. Utilizing online tools or contacting the IRS directly facilitates transcript retrieval.

- Is Code 571 a cause for concern?

- While Code 571 may evoke concern, understanding its implications and taking appropriate steps for resolution can alleviate anxieties and ensure compliance with tax obligations.

- How can I prevent Code 571 from appearing on my transcript?

- Maintaining accurate tax records, promptly addressing outstanding balances, and adhering to IRS guidelines can help prevent triggers for Code 571.

- Can I negotiate payment arrangements for outstanding balances flagged by Code 571B?

- Taxpayers can negotiate payment arrangements with the IRS to resolve outstanding balances and lift freezes imposed by Code 571B. Exploring available options and communicating with the IRS facilitates resolution.

- What documentation may be required to address Code 571A?

- Documentation requirements for addressing Code 571A vary depending on individual circumstances and IRS requests. Taxpayers should promptly furnish any requested documentation to expedite resolution.

- Is professional assistance necessary for resolving Code 571?

- While taxpayers can navigate the resolution process independently, seeking professional assistance from a tax professional may provide valuable insights and expedite resolution, especially in complex cases.

Comments 2